Ho ricevto il bel volume dal titolo L'economia liberale.Saggi per Francesco Forte, a cura di Gian Cesare Romagnoli, mio caro amico e coautore, in cui sono raccolti i saggi presentati da 8 studiosi, nel convegno del 3 aprile 2015 del Dipartimento di Scienze Politiche dell'Università di Roma Tre in mio onore-Quattro di questi studiosi - Gaetana Trupiano, Gian Cesare Romagnoli, Cosimo Magazzino, Guido Maria Rey sono o sono stati professori di Roma Tre, altri 4 .ossia Silvia Fedeli, Giorgo Brosio, Alberto Cassone, Pier Vincenzo Bondonio sono professori miei allievi di Roma Uno e dell'Università di Torino. Di questi magnifici otto , sei sono miei coautori : Gian Cesare Romagnoli e Cosimo Magazzino di Roma 1, e tutti i 4 miei allievi.Rey e Romagnoli sono stati allievi di Federico Caffè , che insegnava politica economica a Roma Uno , ove.per sua inizativa, nel 1994 fui chiamato a subentrare nella cattedra che lsciava per limiti di età. Rey , per breve tempo, e Romagnoli più a lungo, sono stati miei colleghi a Roma Uno. Silvia Fedeli ch ora dirige il Dipartimento di Economia e Diritto dell'Università di Roma Uni , vi ha inziato la sua carriera, come mi ricercatrice, poi come mia giovane collega. Brosio, Bondonio, Cassone sono stati tutti e tre miei laureati e successivamente collaboratori e colleghi nel Laboratorio di Economia Cognetti De Martiis, dell'Università di Torino, ove io ho insegnato, e per gran parte del tempo ho diretto, dal 1961-62 quando, appena trentenne, vincitore di un concorso di cattedra, fui prescelto da Luigi Einaudi, come suo successore, Poi Cassone ha fondato ,insieme ad altri miei allievi e a studiosi di altri dipartimenti, l'Università del Piemonte Orientale, che ha la sua sede principale ad Alessandria, Il volume di saggi che si chiude con una mia postfazione, è molto vario e vivace. Ed io ringrazio, con commzione, questi otto amici.

Torino: sabato 7 aprile 2018. “Globalizzaizone, Mondialismo e Sovranità” ( Prospettiva Monarchica)

La conferenza organizzata dall’U.M.I. di Torino, ha avuto luogo presso l’Hotel Golden Palace nel centro storico della città, grazie all’organizzazione del Presidente provinciale Gen. B. (aus.) Roberto Lopez e del membro dell’Ufficio di Presidenza nazionale avv. Edoardo Pezzoni Mauri. Iniziata con un breve prologo di Roberto Lopez, la conferenza ha trovato sviluppo con gli interventi di Enrica Perucchietti (giornalista e scrittrice), del Prof. Diego Fusaro (filosofo) e del Prof. Francesco Forte (economista ex ministro ). In particolare è stato apprezzato il messaggio relativo alla mancanza di sovranità dello Stato come causa principale delle carenze funzionali dello stesso, mancanza indotta da azioni esogene ad esso da parte di poteri privati e/o statali contrapposti. E’ intervenuto anche l’avvocato Mauri che ha presentato l’ex ministro Forte e la sua azione politica sempre conforme agli interessi nazionali nel quadro del contesto europeo. Al termine della conferenza, il Gen. Lopez ha concluso ricordando ai presenti la determinazione dell’U.M.I. a difendere gli interessi nazionali e la sovranità dello Stato da ogni attacco esterno, Hanno partecipato all’evento circa 130 persone.

foto scattata domenica 17 dicembre alla festa di natale del CLUB FORZA SILVIO, Torino.

Il giorno 17 giugno presenterò il mio saggio sulla Wagner law riguardante la crescita della spesa pubblica in relazione al benessere economico applicata all'Italia dall'unità nazionale ad oggi.

30th Heilbronn Symposion in Economics and the Social Sciences

Forgotten Economists?

Gustav von Schmoller (1838 - 1917) and Adolph Wagner (1835 - 1917)

June 15-17, 2017

Heilbronn, Schießhaus

Preliminary Program

May 27, 2017

Thursday, 18:00 Dinner at “Der Götz” (Urbanstraße 13, near Hauptpost)

June 15

Friday,

June 16

9:00 Jürgen Backhaus (Schleiz)

A Word of Welcome

9:15 Karl-Heinz Schmidt (Paderborn)

Gustav Schmoller’s Program and its Valuation Today and Tomorrow

10:15 Nicholas Balabkins (Bethlehem, USA)

How Schmoller laid the basic foundations for the capitalist welfare state

11:15 Reception by Anton Knittel of the City of Heilbronn

Pressestelle, Besprechungszimmer 2, Room 105 (Foyer)

12:15 Lunch

13:15 Robert W. J. Jansen (Hoofddorp)

Gustav von Schmoller’s influence in the Netherlands 1870-1940; a forgotten economist?

14:15 Ludwig van den Hauwe (Brussels)

Methodenstreit between von Schmoller and Menger

15:15 Annette Godart-van der Kroon (Ludwig von Mises Institute-Europe, Brussels)

Menger contra von Schmoller: the Methodenstreit

16:00 Break for Coffee and Tea

16:30 Dieter Lindenlaub (Leipzig)

Reginald Hansens Schmollerstudien. Die (Wieder)Entdeckung einer wirtschaftswissenschaftlichen Revolution

17:15 Frits L. van Holthoon (Groningen)

Meinecke and the Sonderweg

18:15 Gang Li, Guangdong Baiyun University (China)

Schmoller Research in China and its Potential

18:45 Dinner at the Schießhaus

Saturday,

June 17

9:00 Günther Chaloupek (Vienna)

Adolf Wagner in Vienna – his writings on the Austrian state budget

10:00 Andries Nentjes (Groningen)

Adolph Wagner revisited: is environmental quality a collective need?

11:00 Francesco Forte (Torino)

Wagner’s Law and the public expenditure growth in Italy from 1861 to 2016

12:15 Lunch

13:15 Nicholas Balabkins (Bethlehem, USA)

The partial Demise of Wagner's Public Finance structure after 9/11

14:15 Hans Frambach (University of Wuppertal)

Similarities and Differences in Central Concepts of Social Economy - Adolph Wagner’s Concept of State Socialism and Heinrich Pesch’s Concept of Solidarim

15:15 Ursula Backhaus (Bonn)

German Roots of Health Economics: Gustav von Schmoller and Adolph Wagner

16:15 Where Do We Go From Here?

Abstract del 17 Giugno

PROVISIONAL DRAFT Correct

WAGNER LAW AND GOVERNMENT SIZE AND ECONOMIC GROWTH. AN EMPIRICAL TEST AND THEORETICAL EXPLANATIONS FOR ITALY 1861-2008.

Francesco Forte

Emeritus Professor, Department of Law and Economics, University of Rome La Sapienza and Profess Mediterranean University of Reggio Calabria

Cosimo Magazzino

Associate Professor of economics , University of Rome 3;

Abstract

We econometrically assess-for Italy, for the 1861-208 period, divided in the monarchic and republican periods and in seven subperiods- the Wagner empirical law of growth of public expenditure G by the BARS algorithm on the optimal government size G*, defined as GDP maximisation, which coincides with Wagner rule of optimal public spending growth. Our results show the presence of a non-linear relationship between G and G* with an inverted “U-shape” curve. In the monarchic period until 1914 G< G*. Then from 1919 to 1939 (the non-democratic period) G>G*. In the centre and centre left sub-period of the Republican epoch from 1946 to 1972 again G >G*. In the subsequent unstable period 1973-1992 and in the euro subperiod too G> G*, in spite of the fiscal compact. The empirical Wagner law, as emerging in the Italian case, may be interpreted by Montemartini’ Wagnerian paradigm of the government as a political enterprise which employs its coercive power to distribute the cost of the collective goods approved by its majority (but not necessarily fitting their true preferences) on the entire community. Critical comments follow as for the European rules of the fiscal compact, in their application, as they fail to prevent the damages of the working of the empirical Wagner law.

Keywords: Wagner law, public expenditure, BARS curve, GDP growth, Italian economy.

I SECTION

WAGNER LAW AS AND AN EMPIRICAL LAW AND AS A THEORETICAL PRINCIPLE OF OPTIMALITY

1.1 The Wagner law of increasing expansion of public activities was first presented by A. Wagner, in his period of researches on public finances in Vienna, in 1860-63[1] , in his study of the Austrian state budget (Wagner 1863) in which he presents a systematic classification of its expenditure side, distinguishing state expenditures in the proper sense ordinary and extraordinary (civil and in military emergences) and state expenditures for profit bearing investments[2]. Wagner writes observes that: “On the whole, the realm of the state’s activities has become ever more extensive, as the concept of the state developed, as peoples achieved higher and higher levels of civilization and culture, and the more demands where consequently addressed to the state. This has also led to a continuous increase in the required state revenues, an increase which was generally even higher relative to the increase of the extent of the state activity. The cause of this relative difference lies in the means employed by the state; these have become even more complex, comprehensive and costly as one and the same need required and ever more perfect, higher and refined way of being satisfied. Consider, by way of example, the educational system! The phenomenon has the charter and importance of a “law” in political economy: the requirements of the state are constantly rising as peoples progress” [3] . Wagner does not limit his reasoning to the enunciation of the law of growth of public spending as an empirical law related to the social, civil and economic progress; he also gives a theoretical own explanation of it by its conception of the nature of the state as an organization of higher quality that can fulfil important tasks that enable citizens to satisfy their needs “which cannot be adequately satisfied by individual themselves , noir by free association of individuals, or only at excessive costs” in the pursuance of their “religious, intellectual, economic and material interests” [4] . The concept of Wagner of the state as an entity of superior quality seems to derive from a sort of positivistic organicist Darwinian anthropological view[5]; but could easily be interpreted by an idealistic neo-Hegelian construct or by a mixture of both. What matters in this organicist or idealistic view, it is that the state is an entity in itself which cannot be reduced to the individuals or even the families that are its members. From this basic theorem “the state cannot be reduced to the individuals or the families, member of it” it follows that redistribution among individuals or families is a collective need, because required by the entity of the state as such. Individuals, by definition, cannot provide it spontaneously; only the state can do this properly, and in democracy this may be done by the decisions of the majority as expression of the will of the state[6].

in A. Wagner Grundlegung (1876) vol. I, §10.11 pp.156-159, the Wagner law has been enunciated in historical terms, following the theoretical conception of the state as a superior entity which cannot be reduced to the individuals or families members of it, or merely to the electors and their representatives in a democratic regime. Wagner provides a systematic extensive analysis of the related issues , in his Finanzwisseschaft (1883). [7] Here he provides theoretic principles and offers specific policy suggestions in order to pursue the optimality in the expansion of the public spending and its financing. Wagner argues that it stems from the very nature of the State as a compulsory association of superior quality to do an extensive compulsory acquisition of goods and of personal services, by taxation and expropriation in addition to its large and often innovative commercial activities by which offers goods and services against specific returns[8]. The state thus appears as a big firm of peculiar king both because has compulsory means to raise revenues and pay the services of its debts and because has a perpetual life, unlike the private companies[9]. It must work by a bureaucracy like the big firms, but its bureaucracy, unlike that of the private companies, has not the control of the returns on the market , for most of its activities, This inevitably results in lower working efficiency. “ If the state and the fiscal economy are conceived as a whole, we can speak of the transformation of material in nonmaterial goods”[10].

In democracy, the state is subject to the control of the parliament “ In some respect the government and the Parliament represents the two sides of a business transaction; the government assuming the role of supplier and parliament that of demander for state services. The judgement of each as regards the value and cost of state services may easily be different ;the government may overestimate the value. the advantages accruing to the people and community from public services and underestimate the cost i.e. the sacrifices entailed by taxation ( and its attendant nuisance)” And similarly the other way around” . According to Wagner short sighted public opinion may influence Parliament to make reduction and petty economies. “The guiding principle in examining each case must be: every state activity or form of state activity, and this every expenditure , is to be rejected which imposes on the community a sacrifice exceeding the usefulness or value to the community of the corresponding state service (absolute criterion for rejection) ; or if the same service can be performed equally well but at a less cost by private persons, , association or other public organ like municipalities (relative criterion for rejection)”[11].

Wagner does not share the marginal costs and marginal benefits principles and adopts a mere comparison of average costs and benefits of given public expenditures blocs. But , letting aside this difference in methodology his rule of optimality coincides with the general rule of optimality in the theory of public economy as a process guided by the same individual choice principles than the market: i.e. that expenditures growth must end when the costs of financing them exceed the benefits for the community in terms of GDP maximization, i.e. “BARS optimality”.

Redistribution too must stop, when the costs of is financing reduce national income maximization i.e. – in present national accounting terminology- GDP maximum. Wagner actually he writes “The question of the relation of public expenditure to the national income may also be formulated as follows: should public expenditure be allowed to becomes so high that the required taxation becomes as oppressive burden on the people? ”. The answer is negative “at an rate theoretically-however hard is this may be for the interested parties, especially the politicians concerned-when …the situation of oppressive taxation is likely to become permanent. This is often the case in States which are on the decline”.

One may easily notice how actual is this sentence in several European Union countries and particularly in Italy. Clearly Wagner, the (Conservative party) champion of “state socialism” and of social expenditure and prophet of the welfare state, would argue against the rules of fiscal compact that do not distinguish between expenditure cuts and tax increases as for the budget balancing and the reduction of the debt/GDP ratios.

He -as seen- certainly would distinguish current and capital expenditures and public debt to finance investment or current consumption expenditures.

[1] See G. Chaloupek (2017), Adolph Wagner in Vienna-his writings on the state budget and currency of Habsburg monarchy, in this symposium , pp.

[2] See G. Chaloupek (2017), p§ 3.2

[3] See G. Chaloupek (2017), p§ 3.2

[4] See G. Chaloupek (2017), p§ 3.2

[5] See A. Nentjes (2017), Adolph Wagner revisited: Is redistribution a collective need?, in this Symposium pp. , §2.1

[6] See A. Nentjes (2017) § 3, with the application to Netherland and the paradox that the true preferences of the majority may not be reflected in the over extensive redistributive policies actually adopted by the state under the majority rule principle.

[7] Part I, 3ed ed. Leipzig 1883 p.4 ss., as presented in the English language, in Musgrave and Peacock (1958) , Classics in the theory of public finance, London. New York, MacMillan pp.1-8.

[8] Wagner writes “The nature and extent of state activities must be directed toward the fulfilment of objectives which are recognized as proper and determined in accordance with the interest of the people. In this respect, the State and hence also the fiscal economy are outside the competitive market”. [8]See See Wagner (1883) in Musgrave and Peacock (1958) p..5 too.

[9] “The life of the state is presumed to have unlimited duration. If in the course of history, on state vanishes, it successor takes it places. Therefore, the State can embark on transactions from which individual business is precluded by the very limitation of its life. One point is important for public debt policy strictly speaking only the State can and may contract perpetual debt” [9] See Wagner (1883) in Musgrave and Peacock (1958) p..5.

[10] See Wagner (1883) in Musgrave and Peacock (1958) p. 4

[11] See See Wagner (1883) in Musgrave and Peacock (1958) p..6.

A ONOR DEL VERO,AUTOBIOGRAFIA POLITICA E CIVILE

Giovedì 18 MAGGIO,ALLE ORE 16,30, Presenterò IL MIO ULTIMO LIBRO

'' A ONOR DEL VERO

UN'AUTOBIOGRAFIA POLITICA E CIVILE''

PRESSO IL SALONE DEL LIBRO,TORINO.

SARò LIETO DI INCONTRARE CHIUNQUE VOLESSE PARTECIPARE.

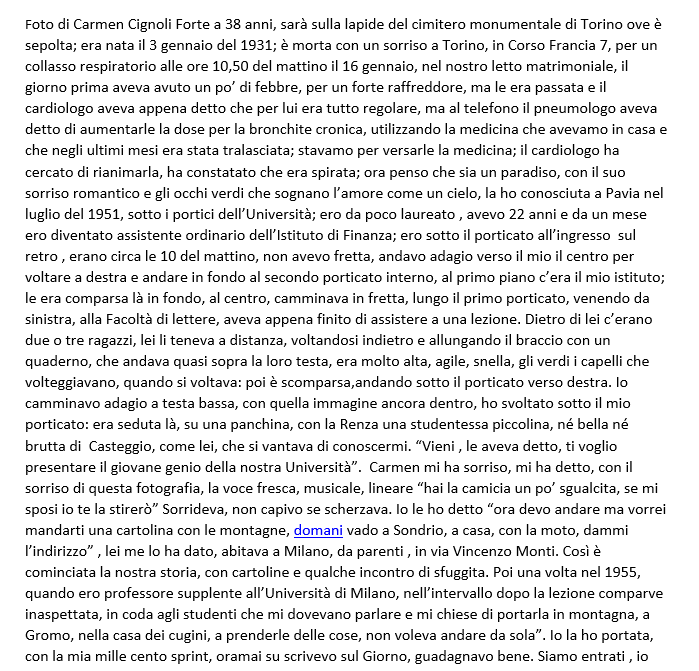

CARMEN

.jpg)

EINAUDI VERSUS KEYNES. 11 OTTOBRE

L'EUROPA AVRà UN FUTURO?

.jpg)

.jpg)

BENI CULTURALI DEL TURISMO. UN VIAGGIO NELLA POESIA DEL MONDO ANTICO.

SONO ONLINE LE LEZIONI MAGISTRALI PRESENTATE NEL 2014 NEL DIPARTIMENTO ARTE DELLA FACOLTà DI ARCHITETTURA DELL'UNIVERSITà MEDITERRANEA DI REGGIO CALABRIA.

è POSSIBILE LEGGERE SLIDE E TESTO NELLA CATEGORIA ECONOMIA DELLA CULTURA NELLA MIA BIBLIOGRAFIA.

INOLTRE SONO DISPONIBILI LE TRE LEZIONI AGGIORNATE CHE PRESENTERò NELLO STESSO TEMA NEL CORSO DI ECONOMIA PUBBLICA PER LA LAUREA SPECIALISTICA IN ECONOMIA DELL'UNIVERSITà MEDITERRANEA DI REGGIO CALABRIA NEL PRIMO SEMESTRE DELL'ANNO ACCADEMICO 2016 2017

Buone ferie a tutti! Prima di ogni viaggio occorre ricordarsi sempre di non tornare mai come si è partiti. L’obiettivo di tutti ad agosto è quello di rientrare quantomeno più carichi di energia!

SAVE THE DATE LUNEDì 18 LUGLIO

NUOVI SAGGI SCARICABILI IN PDF

é uscito il saggio FRANCESCO FORTE ED ELTON BEQIRJ,(2016), Gli effetti negativi della tassazione del patrimonio immobiliare sulla crescita economica. Una verifica empirica sui paesi OCSE 1965-2013 nel volume A.CELOTTO, F. FORTE e E.BEQIRAJ, G.GAFFURI, L. INFANTINO,G.MARINI (2016), a 150 anni dell' imposta reddituale sui fabbricati (1865),ROMA,CONFEDILIZIA EDIZIONI.

scaricabile nella sezione ''PRINCIPALI SAGGI DI ECONOMIA PUBBLICA'' della mia bibliografia.

è uscito il volume di GIANNI MORONGIU (2016) Ezio Vanoni Ministro delle Finanze.

Torino,Giappichelli, 2016, con prefazione di Francesco forte alle pagine X-XXII DEL VOLUME. Il titolo originale della prefazione è '' LA RIFORMA TRIBUTARIA DI VANONI.PERCHè ESSA è ATTUALE A 50 ANNI DALLA SUA MORTE.''

scaricabile nella sezione ''POLITICA ECONOMICA'' della mia bibliografia.

“Integrazione nell’Unione europea: analisi del risultato del referendum UE del 23 giugno 2016 nel Regno Unito”

PERCHè VOTARE NO. LA RIFORMA COSTITUZIONALE RENZI-BOSCHI COMPORTA LO SFRUTTAMENTO DELLA MINORANZA SULLA MAGGIORANZA.

è ONLINE LA STESURA UFFICIALE NELLA SEZIONE SCRITTI POLITICI DELLA MIA BIBLIOGRAFIA SCARCABILE IN PDF.